Plebsource Blog

Solo Mining vs. Pool Mining with Your Bitaxe: Which Path Should You Choose?

At Plebsource.com, we’re all about empowering plebs to take control of their Bitcoin mining journey and help decentralize the network—one Bitaxe at a time. Whether you’re a seasoned miner or a newcomer who just plugged in your first Bitaxe Gamma, you’ve probably wondered: should I solo mine or join a pool? It’s a question we hear often in our community, and it’s a great one. Both solo mining and pool mining have their pros and cons, and the right choice depends on your goals, risk tolerance, and the thrill you’re after. In this blog, we’ll break down the differences between solo mining and pool mining with your Bitaxe, explain how each works, and help you decide which path aligns with your anarcho-capitalist spirit. Plus, for those ready to go fully down the decentralized rabbit hole, we’ll highlight how our plug-n-play Bitcoin full node from Start9 Labs can supercharge your solo mining setup. Let’s dive in and explore how you can make the most of your 1.2 TH/s Bitaxe Gamma to stack sats and secure Bitcoin’s future.

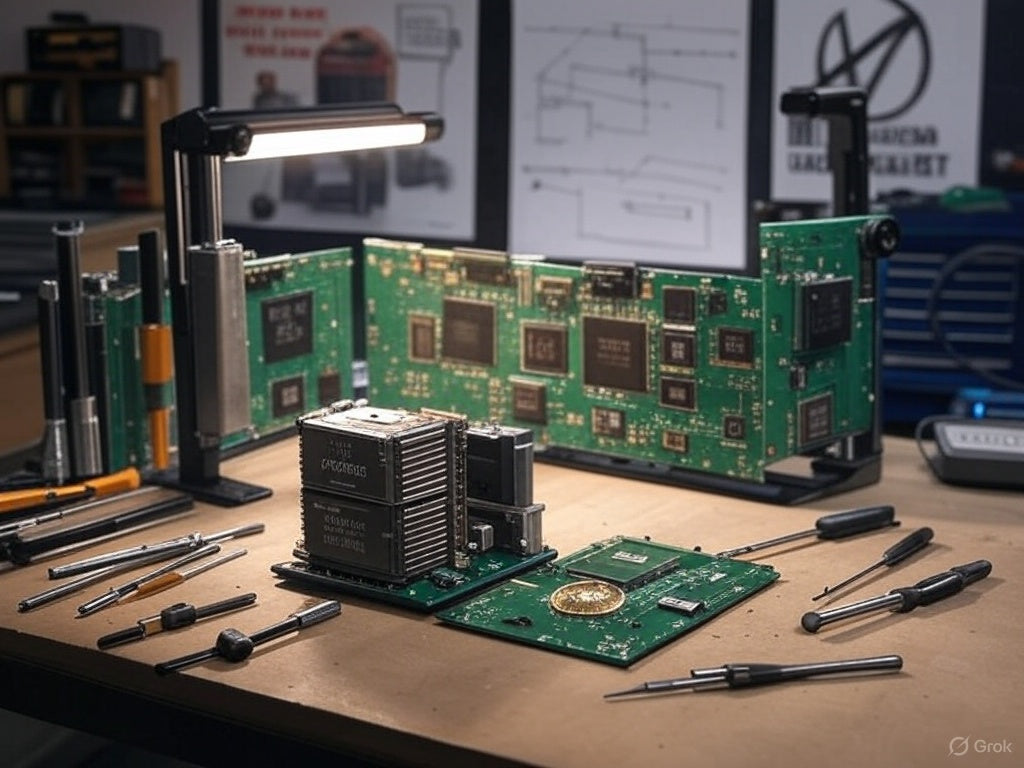

The Next Big Chip: What Plebsource is Watching in ASIC Innovation

The Next Big Chip: What Plebsource is Watching in ASIC Innovation Bitcoin mining is a battleground—a clash between industrial giants and the pleb movement fighting to keep the network decentralized....

Overclocking Your Bitaxe: Pushing Pleb Mining to the Limit

Overclocking Your Bitaxe: Pushing Pleb Mining to the Limit Bitcoin mining isn’t just a technical endeavor—it’s a rebellion against centralized control, a nod to the anarcho-capitalist dream of financial sovereignty....

The Evolution of Bitcoin Mining Hardware: From CPUs to Bitaxe

The Evolution of Bitcoin Mining Hardware: From CPUs to Bitaxe Bitcoin’s journey from a whitepaper dream to a $90,000 asset in March 2025 is a saga of innovation, grit, and...

The Hidden Costs of Industrial Mining: Why Plebs Are Bitcoin’s Last Hope

The Hidden Costs of Industrial Mining: Why Plebs Are Bitcoin’s Last Hope Bitcoin was born as a rebellion—a middle finger to centralized financial systems that thrive on control, inflation, and...

How to Start Mining Bitcoin at Home: A Pleb’s Guide to the Bitaxe

How to Start Mining Bitcoin at Home: A Pleb’s Guide to the Bitaxe Bitcoin mining isn’t just for the suits in server farms anymore—it’s for you, the everyday pleb with...

The Future of Bitcoin Mining: Bridging the Cost Gap for the Pleb Revolution

Bitcoin mining is at a crossroads. On one side, industrial giants churn out terahashes with ruthless efficiency, their sprawling farms powered by cheap hydro and cutting-edge ASICs. On the other, a grassroots rebellion—the pleb movement—is rising, driven by hobbyists, tinkerers, and freedom fighters who believe mining should be for everyone, not just the elite. At Plebsource.com, we’re all in on this vision: democratizing and decentralizing Bitcoin’s hashrate, one home rig at a time. But there’s a glaring obstacle in our path: cost per terahash. Industrial miners clock in at $15-$25 per terahash, while pleb-grade setups like the Bitaxe can cost an order of magnitude more—sometimes $150-$250 per terahash. This gap isn’t just a pricing problem; it’s a threat to the ethos of Bitcoin itself. Let’s explore the future of mining, why cost per terahash is the pleb movement’s Achilles’ heel, and how Plebsource is working to close the divide—without losing sight of our anarcho-capitalist roots

The Art and Economics of Manufacturing a Bitaxe: A Deep Dive into Decentralized Mining

The Art and Economics of Manufacturing a Bitaxe: A Deep Dive into Decentralized Mining Bitcoin mining has come a long way since the days of CPU rigs humming away on...

Why Do My Two Bitaxe Gammas Have Different Best Shares? Understanding Bitcoin Mining Luck

At Plebsource.com, we’re passionate about empowering pleb miners—hobbyists and home enthusiasts like you who are joining the Bitcoin mining revolution with a Bitaxe in hand. We love hearing your questions, as they help us all grow in this anarcho-capitalist mission to decentralize Bitcoin’s hashrate. Recently, a customer reached out with a great question: they have two Bitaxe Gammas, both set up identically and running on the same network, but they’re seeing widely varying “best submitted shares” on their mining pool dashboards. One Bitaxe might have a best share difficulty of 1,000, while the other’s at 10,000—why the big difference? The short answer is: it’s just luck. The longer answer dives into the random yet probabilistic nature of Bitcoin mining, often likened to rolling dice, and how this variance drives the network. In this blog, we’ll explain what “best shares” mean, why your two Bitaxes are showing different results, and how Bitcoin mining luck works. By the end, you’ll see why this variance is normal, expected, and even a beautiful part of what makes Bitcoin mining so unique. Let’s roll the dice and break it down.

Understanding Vardiff: Why Your Bitaxe’s Rejected Shares Are Normal—and How It’s Helping You Mine Smarter

Bitcoin’s Core Values: Hard Money and the Rise of the Home Miner

Pleb Day 2025: A Massive Win for Decentralized Mining—Thank You, Plebs!